Aging adults often show signs of slowing when it comes to managing their finances, such as calculating their change when paying cash or balancing an account ledger.

These changes happen even in adults who are cognitively healthy. But trouble managing money can also be a harbinger of dementia and, according to new Duke research in The Journal of Prevention of Alzheimer’s Disease, could be correlated to the amount of protein deposits built up in the brain.

“There has been a misperception that financial difficulty may occur only in the late stages of dementia, but this can happen early and the changes can be subtle,” said P. Murali Doraiswamy, MBBS, a professor of psychiatry and geriatrics at Duke and senior author of the paper. “The more we can understand adults’ financial decision-making capacity and how that may change with aging, the better we can inform society about those issues.”

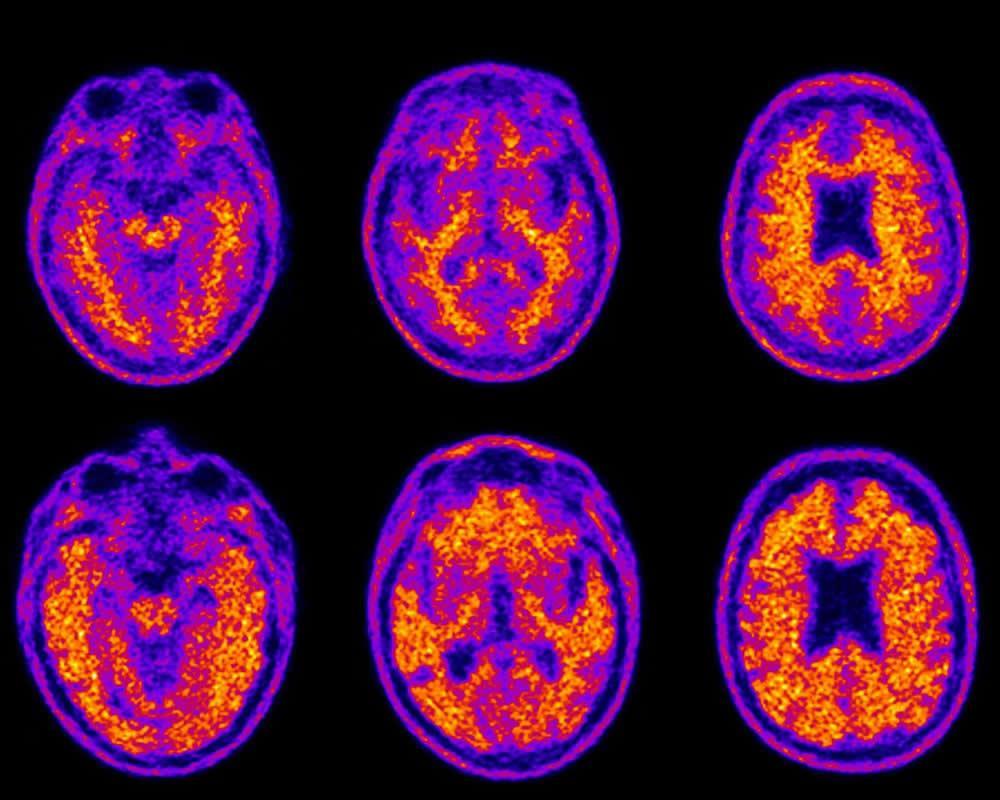

The findings are based on 243 adults ages 55 to 90 participating in a longitudinal study called the Alzheimer’s Disease Neuroimaging Initiative, which included tests of financial skills and brain scans to reveal protein buildup of beta-amyloid plaques.

The study included cognitively healthy adults, adults with mild memory impairment (sometimes an Alzheimer’s precursor) and adults with an Alzheimer’s diagnosis.

Testing revealed that specific financial skills declined with age and at the earliest stages of mild memory impairment. The decline was similar in men and women. After controlling for a person’s education and other demographics, the scientists found the more extensive the amyloid plaques were, the worse that person’s ability to understand and apply basic financial concepts or completing tasks such as calculating an account balance.

“Older adults hold a disproportionate share of wealth in most countries and an estimated $18 trillion in the U.S. alone,” Doraiswamy said. “Little is known about which brain circuits underlie the loss of financial skills in dementia. Given the rise in dementia cases over the coming decades and their vulnerability to financial scams, this is an area of high priority for research.”

Even cognitively healthy people can develop protein plaques as they age, but the plaques may appear years earlier and be more widespread in those at risk for Alzheimer’s disease due to a family history or mild memory impairment, Doraiswamy said.

Most testing for early dementia and Alzheimer’s disease focuses on memory, said Duke researcher Sierra Tolbert, the study’s lead author. A financial capacity assessment, such as the 20-minute Financial Capacity Instrument-Short Form used in the Duke study, could also be a tool for doctors to track a person’s cognitive function over time and is sensitive enough to detect even subtle changes, she said.

“Doctors could consider proactively counseling their patients using this scale, but it’s not widely in use,” Tolbert said. “If someone’s scores are declining, that could be a warning sign. We’re hoping with this research more doctors will become aware there are tools that can measure subtle changes over time and possibly help patients and families protect their loved ones and their finances.”

In addition to Doraiswamy and Tolbert, study authors include Yuhan Liu, Caroline Hellegers, Jeffrey R. Petrella, Michael W. Weiner and Terence Z. Wong.

This research used data from the Alzheimer’s Disease Neuroimaging Initiative, which is funded by the National Institutes of Health (U01 AG024904) and the U.S. Department of Defense (W81XWH-12-2-0012), as well as the National Institute on Aging, the National Institute of Biomedical Imaging and Bioengineering, and through contributions from numerous other organizations. A full list of contributors and financial disclosures is available with the manuscript.